The state-owned "PrivatBank" explained what influences the decision to provide credit limits to clients after Ukrainians began to complain about the restriction of this right.

This information was published on the "Minfin" portal, where users can leave feedback about the performance of banks.

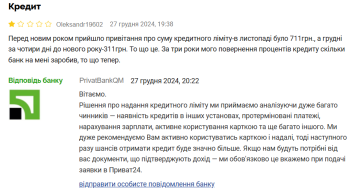

A message from a "PrivatBank" client noted that at the end of last year, the bank halved his credit limit. The man expressed surprise at this decision, as he had been using credit for three years, and the bank had been earning interest on his loan.

However, on the eve of the New Year, the limit was reduced. "Before the New Year, I received a congratulatory message about the credit limit amount — it was 711 UAH in November, and four days before the New Year in December — it was 311 UAH. So what is this? For three years of repaying interest on the loan, how much has the bank earned from me, and now this?" - the client writes to "PrivatBank".

PrivatBank explained that the decision to provide a credit limit is based on several factors, including: the presence of loans at other financial institutions; overdue payments; salary accruals; card usage activity; and other factors.

On the PrivatBank website, it is emphasized that the credit limit is a significant advantage of credit cards compared to regular loans, as clients can access borrowed funds at any time. At the same time, there is an opportunity to avoid overpayments on interest if the debt is repaid within the grace period.